pay indiana state property taxes online

Only authorized banks can accept on-time payments. Pay my tax bill in installments.

Property Tax How To Calculate Local Considerations

Check out Jefferson Countys website to see a comprehensive.

. You need to come in the office and bring cash or certified funds. Find Indiana tax forms. Properties that are in the Tax Sale Process are not available online.

Search by address Search by parcel number. Claim a gambling loss on my Indiana return. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Discover Indiana Property Tax Online Payment for getting more useful information about real estate apartment mortgages near you. Gain access to your online tax payment receipts. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

Please contact the Indiana Department of Revenue at 317 232-1497. In spite of this there is still one dollar to be had. Innkeeper Form 2018 Property taxes in Cass County will be due Spring May 10 2021 and Fall November 10 2021.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. State Excise Police Indiana. The average tax rate in Jefferson County is 74 of propertys assessed fair market value.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Can a tax assessor enter my property in Indiana. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247. National Guard Indiana. Contact the Property Tax Office by phone to request a payment schedule.

For more information click here. You will need to have information on the parcel you are paying. You may also register with or login to our website to view update and add parcels to your profile.

Register to receive other updates from the county. The Treasurer is an elected position authorized by Article 6 Section 2 of the Indiana Constitution and serves a four 4 year term. Homeland Security Department of.

You may pay your taxes by CreditDebit CardACH Check online at Paygov by phoning 1-866-480-8552. Associate all of your parcels for easy payments in the future. You MUST present your current Treasurers Spring andor Fall copy at the local bank along with your payment.

Search for your property. If you want your property tax to be mailed to you send it to You can do this by paying with the bank that participates in the program. Call 855-423-9335 with questions.

You may pay real personal and mobile home tax online. Find Indiana tax forms. Take the renters deduction.

If you have any questions please call the office. Indianapolis Marion County Payment Portal. Indiana Career Connect.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. If you need to walk-in. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. INTAX only remains available to file and pay special tax obligations until July 8 2022. 124 Main rather than 124 Main Street or Doe rather than John Doe.

Property taxes can be paid by cash check cashiers check money order credit card debit card or e-check. Online and phone payments may take 2-5 business days to process in our office. For best search results enter a partial street name and partial owner name ie.

Claim a gambling loss on my Indiana return. However the chapter of Indianas property tax code addressing real property assessment provides that a county assessor or authorized representative may after first making known the assessors or representatives intention to the owner or occupant enter and fully examine all buildings and structures which. Have more time to file my taxes and I think I will owe the Department.

Law Enforcement Academy Indiana. Please enter 4TAX 4829 or 1888 into the box below. This means residents pay about 791 155 of their yearly income a year in property taxes.

Indianas state average property tax rate is 85 ranking it the 27th highest in the country. How Do I Pay My Indiana Property Taxes. You should also know the amount due.

In case of delinquent taxes the sale of real property to pay. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Payments are counted when we receive them in office NOT when the transaction is started.

Criminal Justice Institute. Pay my tax bill in installments. Online access to a prior-year property tax payment history is free to access.

Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. Know when I will receive my tax refund. Tips for Your Job Search.

Corrections Indiana Department of. Pay by phone toll free. E-Check Visa Mastercard Discover and American Express accepted.

The primary duty of the Treasurer is that of tax collector. The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law. There is a 395 or minimum convenience fee for this service that is retained by Paygov.

Full and partial payments accepted. Jobs Marketplace. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

INtax only remains available to file and pay the following tax obligations until July 8 2022. Have more time to file my taxes and I think I will owe the Department. Take the renters deduction.

If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale. Know when I will receive my tax refund.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Property Tax Calculator Smartasset

Disabled Veterans Property Tax Exemptions By State

Orange County Ca Property Tax Calculator Smartasset

28 Key Pros Cons Of Property Taxes E C

Https Tedthomas Com Portfolio Video Is Indiana A Tax Lien State The Rules And Regulations For Each State Are Different When It C Indiana Tax How To Find Out

34 Horsham Pa With Low Property Taxes And High End Office Parks Horsham Has Been Able To Attract Over 600 Companies Best Places To Live Country Roads Park

Thinking About Moving These States Have The Lowest Property Taxes

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

The Average Amount People Pay In Property Taxes In Every Us State

Pennsylvania Property Tax H R Block

Deducting Property Taxes H R Block

A Breakdown Of 2022 Property Tax By State

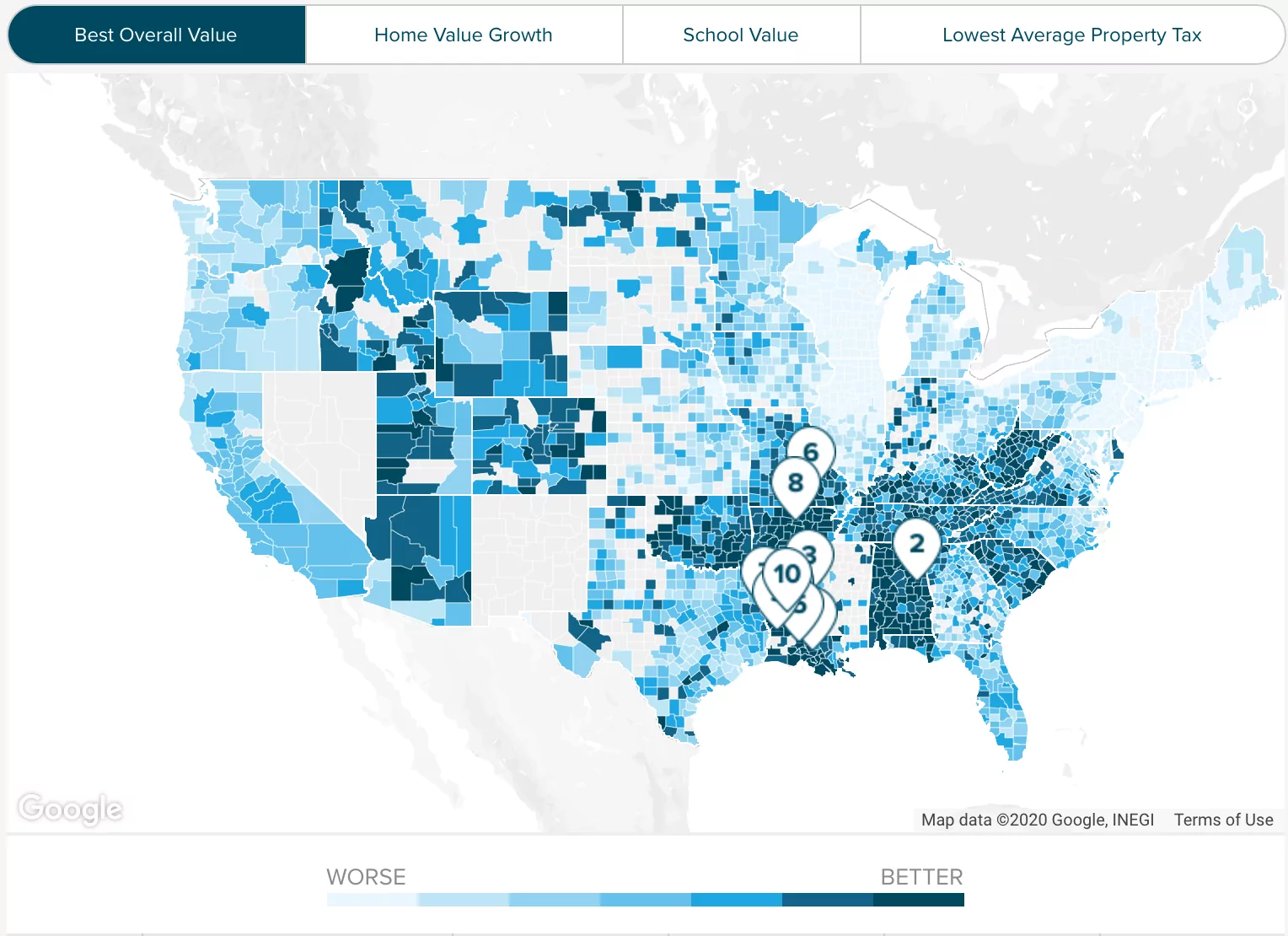

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State Embrace Higher Property Taxes

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)